How Much Savings on Equipment for a Planet Fitness Franchise

Understanding the scope of equipment costs and potential savings for a Planet Fitness franchise

Starting a Planet Fitness franchise involves more than securing site location and securing branding; a substantial portion of the capital investment goes toward equipment. The equipment mix — cardio machines, resistance equipment, free weights, flooring, and ancillary gear — shapes both initial outlay and ongoing maintenance. A key question for any aspiring franchisee is not only what you must buy, but how to optimize price without compromising safety, compliance, or member experience. Industry reports and franchise disclosures suggest that total initial investments for gym concepts typically range widely by market and footprint, with equipment costs representing a meaningful slice of the capital stack. While Planet Fitness emphasizes a value-driven model, you still face the same procurement decisions as any commercial gym operator: new versus refurbished, bundled purchases, vendor financing, warranties, and long-term maintenance commitments.

In practical terms, savings potential comes from four primary levers: (1) negotiating with manufacturers and distributors for multi-unit discounts, (2) leveraging refurbished or gently used equipment with solid warranties, (3) optimizing the equipment mix to fit the target market and floor plan, and (4) aligning procurement with a rigorous lifecycle plan that minimizes surprise capex. For plan-builders and operators, the goal is a credible, data-driven procurement plan that can be executed within your franchise agreement timelines. Real-world results show that franchisees who establish formal supplier rosters, bid gatekeepers, and depreciation-friendly financing can reduce upfront equipment costs by double-digit percentages without sacrificing safety, warranty protections, or the member experience.

As you craft your financing and equipment strategy, a practical starting point is to document a detailed requirements list, estimate per-item costs, and build a comparison matrix for new, refurbished, and rental options. This approach creates a transparent baseline for decision-making and makes it easier to quantify potential savings in terms of upfront cash outlay, monthly payments, and long-term maintenance budgets. It also helps you communicate with the franchisor and lenders about risk, return, and the lean setup that supports Planet Fitness’ business model: high value, brisk turnover, and sustainable operations.

Next, we will break down equipment cost categories, provide typical price ranges, and illustrate savings opportunities with concrete tactics, including step-by-step guides for negotiating, bundling, and financing. By the end of this section, you should have a structured plan to maximize value while meeting Planet Fitness’ equipment standards and safety requirements.

Equipment cost categories and realistic saving targets

Opening a Planet Fitness franchise requires a comprehensive equipment suite that supports cardio intensity, strength development, functional training, and general wellness. The cost structure typically includes four major categories: cardio equipment, strength and functional machines, free weights and racks, and ancillary items (floors, mats, benches, safety equipment, and maintenance tools). Within each category, there are multiple price points, depending on newness, warranty, and manufacturer programs. A practical saving target for a well-planned procurement program is in the range of 15%–35% of the total equipment budget, achieved through a combination of bundles, refurbished units with warranties, and negotiated payment terms.

Cardio equipment: treadmills, ellipticals, bikes

Cardio machines typically dominate the equipment budget due to unit count and durability requirements. A commercial treadmill can range from $3,000 to $8,000 per unit when purchased new; ellipticals often run $3,000–$7,000; upright or recumbent bikes may be $1,500–$4,500. For a mid-size Planet Fitness floor plan with 40–60 cardio units, the new-equipment cost can be substantial. Savings opportunities include:

- Bundled quotes from a single supplier for all cardio units to secure volume discounts.

- Evaluating refurbished units with credible warranties (often 12–36 months) and service options.

- Staggered capital purchases aligned with opening milestones to leverage seasonal promotions.

- Prioritizing energy-efficient models to reduce operating costs and eligible tax incentives.

Reality check: refurbished cardio equipment can offer 30%–60% savings relative to new, provided warranties and service coverage remain robust. Always verify service history, maintenance logs, motor hours, and safety certifications before purchase.

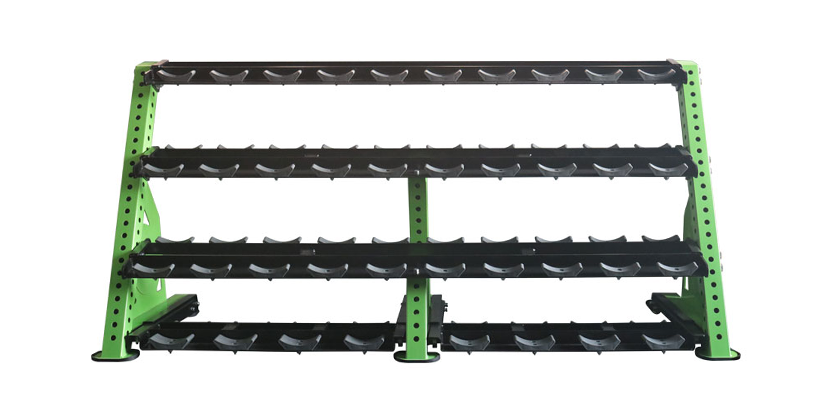

Strength and functional training: selectorized machines, free weights, racks

Strength and functional zones are essential but vary in cost based on selection strategy. Selectorized machines typically cost $5,000–$15,000 per piece, while plate-loaded machines may be in the $3,000–$9,000 range. Free weights (adjustable barbells, dumbbells, kettlebells) and racks contribute a meaningful line item but can be budgeted with longer replacement cycles if you mix brands and negotiate warranties. Savings levers include:

- Choosing modular strength lines that allow incremental expansion rather than full-lighting replacements.

- Purchasing refurbished leg extension, press, and row machines with extended warranty options.

- Negotiating multi-unit deals and including parts and service in the contract.

The balance is to maintain a diverse selection that supports a broad member base while staying within a defined budget. A well-planned mix often reduces initial spend by 20%–30% compared to an all-new, full-spec setup, with long-term operating costs kept in check through preventive maintenance and timely part replacements.

Best practices to maximize equipment savings before opening

Proactive procurement strategies are essential in the months leading to a Planet Fitness grand opening. A structured, step-by-step approach can convert negotiating power into measurable savings while ensuring compliance with the franchisor’s standards and local regulations. The core steps include establishing a procurement framework, issuing competitive bids, evaluating warranties, and aligning with financing options that support cash flow and tax efficiency.

Step-by-step procurement plan

- Define the equipment baseline: confirm required machine counts per category based on the franchise layout, anticipated member load, and floor space constraints.

- Solicit at least three formal bids per category with defined specifications (brand minimums, warranty terms, service response times, and maintenance coverage).

- Create a decision matrix that weighs price, warranty, delivery lead times, and total cost of ownership (TCO).

- Explore bundled packages from manufacturers that support multi-unit deployments and align with opening schedules.

- Negotiate payment terms, including deposits, milestones, and post-opening maintenance credits.

Negotiating with vendors and bundling strategies

Negotiation outcomes improve when you present a clear plan and leverage potential multi-unit opportunities. Tactics include:

- Ask for tiered discounts tied to unit count or total spend within a single procurement window.

- Request inclusive warranties and on-site service windows to minimize downtime during opening weeks.

- Bundle cardio with strength equipment to unlock higher discounts and simplified logistics.

- Negotiate freight, installation, and calibration as part of the contract, rather than as separate charges.

Expected savings: 10%–25% in early negotiations, rising to 20%–35% when combining multi-year service agreements and extended warranties.

Refurbished versus new: evaluating risk and ROI

Refurbished equipment can deliver significant upfront savings, but you must quantify risk through warranties, uptime guarantees, and service coverage. A robust approach is to:

- Limit refurbished purchases to units with less than a specific runtime (e.g., under 4,000 hours for cardio).

- Combine refurbished units with new units in high-traffic areas to balance reliability and cost.

- Protect uptime with a service-level agreement (SLA) that includes rapid replacement or on-site repair within 48–72 hours.

ROI impact depends on uptime and maintenance costs. A conservative rule of thumb is that refurbished equipment with strong warranties can reduce upfront spend by 25%–40% while maintaining acceptable long-term reliability.

Case studies and data-driven ROI

Two representative scenarios illustrate how savings translate into real-world outcomes for Planet Fitness franchise openings. Scenario A reflects a multi-unit, refurbished-first approach, scenario B shows a new-equipment-heavy strategy with premium warranties. Both assume a floor plan of approximately 12,000–15,000 square feet with 40–60 cardio units and 6–12 strength stations, and a 3–5 year ramp period before full membership targets are reached.

Case study A: bundling and refurbished equipment deliver 28% upfront savings

In Case A, the franchisee negotiated a bundled cardio and strength package across three units, added refurbished cardio units with tested warranty terms, and locked in fixed-price installation and calibration. Key outcomes included:

- Upfront equipment cost reduction: 28% below all-new estimates.

- Average maintenance spend reduced by 12% in the first 3 years through bundled service contracts.

- Open-to-break-even timeline shortened by 6–9 months due to faster procurement and predictable maintenance windows.

This approach demonstrated that strategic bundling and careful selection of refurbished units can unlock accelerated time-to-value without compromising member safety or brand standards.

Case study B: targeted new purchases with extended warranties yield smoother scaling

Case B focused on securing a lean initial floor with a mix of new cardio units and modular strength stations, paired with a 5-year service plan and manufacturer-partner financing. Results included:

- Balanced capital expenditure with favorable financing terms, preserving working capital.

- Higher uptime and reduced unexpected capex due to proactive maintenance coverage.

- Clear depreciation schedule aligned with tax planning, improving cash flow in the first 3–5 years.

Both cases illustrate that a disciplined procurement framework, guided by risk tolerance and ROI targets, can substantially influence the total cost of equipment and the speed at which a Planet Fitness franchise becomes profitable.

Maintenance, amortization, and ongoing savings

After opening, ongoing savings hinge on maintenance discipline, spare-part strategies, and tax-efficient depreciation. A practical approach blends preventive maintenance, inventory management, and smart financial planning to keep operating costs predictable while preserving member satisfaction. Expected ongoing costs include routine servicing, filter changes, calibrations, and occasional replacements for worn-out components. A robust plan ensures uptime, reduces emergency repairs, and minimizes revenue loss from equipment downtime.

Maintenance scheduling and spare parts strategy

To control maintenance costs, implement a calendar-based preventive maintenance program, with quarterly checks for cardio units and annual calendar reviews for high-wailure parts. Maintain an on-site spare parts kit for fast replacements and establish relationships with local service partners for rapid response. A calculated spare parts reserve may range from 2% to 5% of total equipment value annually, depending on fleet age and usage intensity.

Financing, depreciation, and tax benefits

Tax and finance considerations influence the overall cost of ownership. Depreciation methods (e.g., MACRS in the United States) allow recovery of equipment costs over several years, improving cash flow. Financing arrangements can include vendor-specific leases, bank loans, or franchise-backed financing programs. A disciplined depreciation schedule, aligned with cash flow projections, supports capital reallocation for future upgrades and campus expansions. Always coordinate with a tax professional and the franchisor to ensure compliance and maximize eligible deductions.

FAQs

1. How much can I realistically save on equipment when opening a Planet Fitness franchise?

Typical upfront equipment cost savings from bundling, negotiating on multi-unit orders, and using refurbished units can range from 15% to 35% of the equipment budget, depending on market conditions, supplier terms, and the mix of new versus refurbished equipment.

2. Should I buy new or refurbished equipment?

New equipment offers the latest features, warranties, and potentially longer service life. Refurbished units can deliver substantial upfront savings if backed by credible warranties and rapid service availability. A hybrid approach often yields the best balance of cost and reliability.

3. What are the key negotiation levers with suppliers?

Key levers include: (a) multi-unit discounts and bundled packages, (b) inclusive warranties and service level agreements, (c) fixed-price installation, (d) favorable financing terms, and (e) flexible delivery windows aligned with opening schedules.

4. How does maintenance affect long-term savings?

Preventive maintenance reduces downtime, extends equipment life, and lowers emergency repair costs. A dedicated maintenance budget and SLA with providers can stabilize operating costs and support predictable ROI.

5. What are typical warranty terms for gym equipment?

Warranty terms vary by brand and model, but commonly include 1–3 years on parts, with some providers offering extended coverage or on-site service for a cost. Review the warranty scope for wear items, motor life, and call-out times.

6. How should I plan for equipment lifecycle and replacements?

Develop a 5–7 year lifecycle plan with scheduled evaluations of each unit’s performance, downtime frequency, and user feedback. Plan for phased replacements to avoid large capex spikes and to maintain brand standards.

7. What role does the franchisor play in equipment provisioning?

The franchisor often provides recommended specifications, preferred vendors, and minimum standards. They may also offer group purchasing programs and brand alignment that influence supplier choices and discount levels.

8. How can I estimate total cost of ownership (TCO) for equipment?

Calculate TCO by summing upfront purchase price, installation, shipping, warranty costs, ongoing maintenance, parts, energy usage, and anticipated downtime. Compare TCO across alternative equipment configurations to identify the most cost-efficient solution.

9. Are there financing options specific to franchise openings?

Yes. Franchise-specific financing, vendor leasing, bank loans, and sponsor programs can offer favorable terms. Work with lenders who understand the franchise model and can assess your projected cash flows and break-even timelines.

10. How do I benchmark equipment costs for a Planet Fitness opening?

Benchmark against peer franchise openings, vendor quotes, and the franchisor’s recommended equipment lists. Use a standardized comparison template to evaluate price, warranty, delivery, and service terms across bids.

11. What risks should I plan for in equipment procurement?

Risks include delays in delivery, supply price volatility, warranty gaps, and downtime during opening. Mitigate by locking in deposits and delivery windows, maintaining spare parts, and securing service contracts ahead of the launch.