Where can I buy wholesale fitness equipment

Understanding the wholesale fitness equipment market

The wholesale fitness equipment market forms the backbone of gym development, studio expansion, and retail fitness storefronts. It connects manufacturers, distributors, and retailers to deliver bulk quantities of durable gear at competitive prices. For buyers, wholesale sourcing means access to better unit costs, consistent product availability, and the ability to curate a mix that fits a brand’s service model—whether that’s a boutique studio needing compact machines or a large gym chain requiring heavy-duty cardio rigs and multi-function strength stations.

Global market dynamics influence wholesale decisions. In 2023, industry observers estimated the combined value of gym equipment sales to be in the multi‑billion USD range, with a steady compound annual growth rate (CAGR) forecast around 4–6% through the next five years. The drivers are clear: rising health consciousness, the expansion of small-group training concepts, and the proliferation of hotel and corporate wellness programs. As a result, buyers increasingly evaluate suppliers not only on price, but on reliability, lead times, post‑sale service, and the ability to offer scalable solutions across multiple locations.

For practical sourcing, sector insights show that wholesale buyers typically segment products into several core categories with distinct procurement considerations: cardio machines, strength and functional training stations, free weights and racks, mats and flooring, and accessories. Each category carries its own cost structure, warranty expectations, and logistics profile. Understanding these categories helps buyers build a balanced catalog that supports steady usage, minimizes downtime, and aligns with target utilization rates in facilities.

Finally, the wholesale path often involves three archetypes of buyers: gym operators who purchase for rollout or refresh, fitness retailers who stock a broad range to serve home gyms, and boutique studios that need compact, dependable equipment with a premium finish. Each archetype has different volume bands, service expectations, and certification requirements, which in turn shape supplier selection and negotiation tactics.

Product categories in wholesale fitness equipment

Wholesale buyers typically organize their catalogs into five primary families: cardio, strength, free weights and racks, flooring and mats, and accessories. Each family presents unique value propositions and compatibility considerations:

- treadmills, ellipticals, stationary bikes, rowers. Commercial units emphasize uptime, service networks, and safety certifications. Typical wholesale price bands range from a few hundred dollars for basic accessories to $2,000–$8,000+ per unit for premium treadmills or commercial-grade bikes. Lead times often span 2–6 weeks, with longer windows for high-demand models.

- Strength and functional training: multi‑gyms, cable machines, leg press, smith machines, and functional racks. These units are heavier, more durable, and frequently priced from $1,000 to $7,000+ per station depending on configuration and branding. Customizations, warranty terms, and on-site installation are common value adds.

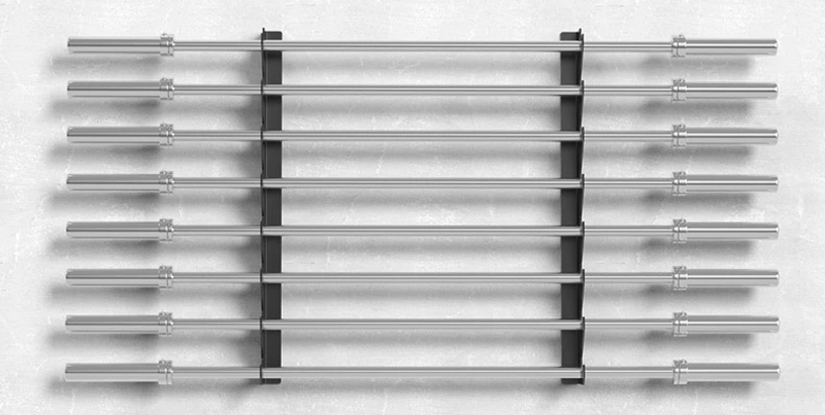

- Free weights and racks: dumbbells, kettlebells, weight plates, and modular rack systems. Costs depend on material (cast iron vs urethane-coated), weight range, and packaging. Wholesale bands of 5–20% discounts are common for large-volume orders; shipping is a significant factor due to irregular shapes and weights.

- Flooring and mats: rubber flooring tiles, turf rolls, and protective mats. These items are essential for safety and maintenance; they typically feature lower unit cost but high total area requirements, influencing freight and installation planning.

- Accessories and small equipment: benches, mats, medicine balls, medicine balls, resistance bands, and clip collars. Accessories often have favorable MOQs and shorter lead times, enabling quick restocking and seasonal promotions.

Practical tip: when planning a catalog, perform a utilization forecast for each category. For instance, a mid-size gym may allocate 20–30% of space to cardio, 40% to strength stations, 15% to free weights, and the remainder to flooring and accessories. This helps align order quantities with actual usage and reduces overstock risk.

Pricing, MOQs, and margins

Wholesale pricing is driven by volume, lead time, and supplier proximity. Typical ranges you may encounter include:

- Cardio machines: $2,000–$8,000 per unit for commercial-grade treadmills, $1,500–$4,500 for ellipticals and bikes, with higher-end options priced above $10,000.

- Strength machines and multi-gyms: $1,000–$7,000 per station, depending on number of stations, weight stacks, and build quality.

- Free weights and racks: dumbbells $1.50–$3.50 per pound (cast iron), racks and benches typically $150–$900 each, with volume discounts of 5–20% for large orders.

- Flooring and mats: rubber tiles $2–$5 per sq ft, mats $1–$5 per sq ft depending on thickness and material.

- MOQs (minimum order quantities): small items may require 10–20 units; large commercial machines often require 1–3 units per SKU, with case-by-case adjustments for color or configuration.

Gross margins in wholesale purchasing vary by category and channel. Typical gross margin targets for gym operators range from 20–40% on new equipment when bundled with installation, service contracts, or warranty extensions. Retailers seeking higher margins on home-gym assortments may pursue 30–50% gross margin by combining promotional pricing with bundled accessories and financing offers.

Quality standards and certifications to look for

Quality and safety are non-negotiable in wholesale fitness equipment. Buyers should evaluate the following indicators when screening suppliers:

- Certifications: ISO 9001 quality management, CE marking for European compliance, and third-party safety certifications applicable to sport and fitness equipment.

- Materials and build: steel frames, corrosion-resistant finishes, load ratings appropriate to intended use, and smooth, consistent welds.

- Warranty and service: minimum 1–2 year parts and labor warranties for commercial equipment; clear terms on on-site service, spare parts availability, and response times.

- QA/testing: factory acceptance tests, functional tests, and random sampling for quality control before shipment (often documented in a test report).

- Factory traceability: ability to provide bill of materials, production batch data, and supplier due diligence records.

Best practice: request a formal pre-shipment inspection (PSI) and sample units for functional testing. If you’re a multi-location operator, consider a small pilot order to validate performance in your environment before scaling.

Case study: a mid-size gym chain sourcing wholesale equipment

Consider a 5-location gym chain planning a refresh with an annual equipment budget of $1.2 million. The buyer defined a mixed catalog: 40% cardio, 35% strength, 15% free weights/racks, and 10% flooring and mats. They used a two-tier sourcing approach: direct factory negotiations for core cardio and strength lines and a regional distributor for accessories and mats to reduce freight complexity. Over a six-month pilot, the chain achieved a 12% overall cost reduction versus prior-year procurement by consolidating orders with fewer suppliers, increasing order sizes, and locking in a 60-day price protection window. They also implemented a standardized inspection protocol and a warranty tracker, which reduced downtime by 18% in the first year.

Sourcing strategies and procurement workflow

Effective wholesale purchasing hinges on a clear workflow. This section outlines practical strategies to minimize risk, reduce total landed cost, and accelerate time-to-site readiness.

Direct factory sourcing vs distributors: pros and cons

Direct factory sourcing can offer the strongest unit prices and customization options, but it often requires complex logistics, longer lead times, and higher minimum volumes. Distributors provide a buffer—local stock, shorter lead times, and easier warranty handling—but can add a middleman premium. A blended approach is common: secure core SKUs directly from manufacturers for price and control, and source accessories, flooring, and seasonal items through reputable distributors to maintain agility. Key considerations include:

- Lead times and production calendars; backup plans for supply chain disruptions.

- Minimum order quantities and storage capacity; space planning for the showroom and warehouse.

- Warranty and service networks; local technician coverage reduces downtime.

Evaluating suppliers: samples, audits, and site visits

Due diligence is essential. A structured supplier evaluation includes:

- Requesting product samples to assess build quality, feel, and safety features.

- Reviewing factory audit reports (quality systems, environmental controls, social compliance).

- Planning on-site visits or virtual tours to verify manufacturing capabilities and capacity.

- Asking for reference customers and case studies to understand real-world performance.

Negotiating terms: price, lead time, warranties

Negotiation strategies focus on achieving a balanced scorecard: price certainty, reliability, and service. Tactics include:

- Requesting tiered pricing tied to annual volume commitments.

- Securing price holds and indexed pricing to offset inflation risks.

- Locking in lead times with firm production windows and penalties for delays.

- Negotiating extended warranties or service contracts to protect uptime.

Logistics, shipping, and import considerations

Logistics can significantly affect total cost. Practical steps include:

- Comparing freight terms (FOB, CIF, DAP) and calculating landed cost for each SKU.

- Choosing between air freight for urgent needs and sea freight for large volumes to optimize cost per unit.

- Coordinating with freight forwarders on documentation, incoterms, and customs clearance.

- Planning packaging optimization to minimize damage and simplify handling at site.

Quality control and post-shipment checks

After shipment, implement a quality control sequence to prevent downtime:

- Perform a PSI where possible, or engage a third-party QC service.

- Track delivery performance and inspect for damaged parts on arrival; replace faulty units promptly.

- Maintain a warranty log and establish a spare-parts inventory for quick fixes.

Practical implementation: from order to showroom

Turning a wholesale order into a showroom-ready fleet involves careful planning, inventory management, and ongoing optimization. This section covers actionable steps you can implement in a typical procurement cycle.

Inventory planning and warehousing

Begin with a demand forecast aligned to facility rollout plans. Create a stock matrix that includes lead times, safety stock, and reorder points for each SKU. Consider space optimization by reserving dedicated zones for high-rotation cardio units and high-use strength machines. Use slotting strategies to minimize picking time and reduce handling costs.

Digital tools and automation for wholesale purchasing

Adopt procurement software and supplier portals to streamline RFQs, orders, and contract management. Features to prioritize include: supplier scorecards, real-time stock visibility, automated reordering rules, and integration with ERP or inventory management systems. A modern approach reduces manual errors and accelerates decision cycles.

Risk management and compliance

Identify and mitigate common risks: supplier insolvency, currency fluctuations, regulatory changes, and transport disruptions. Build risk controls such as multi-sourcing for critical SKUs, defined exit strategies, and clear contractual remedies. Maintain compliance records for certifications, warranties, and safety standards to support audits and insurance requirements.

Sustainability, service, and warranties

More operators are weighing environmental impact and long-term service. Choose suppliers with recycled content programs, energy-efficient designs, and robust after-sales service networks. Bundle warranties with on-site service options to reduce downtime and improve lifecycle cost management. Track service requests and repair times to continuously improve equipment uptime.

Frequently Asked Questions

Q1: What is wholesale fitness equipment?

A: Wholesale fitness equipment refers to purchasing gym gear in bulk from manufacturers or distributors at discounted per-unit prices. Buyers include gym operators, studios, and retailers who resell or deploy the equipment across multiple locations.

Q2: How do I start sourcing wholesale fitness equipment?

A: Define your product mix, set a budget and MOQs, request samples, vet suppliers via audits and references, and pilot a small order before scaling.

Q3: Should I buy directly from manufacturers or through distributors?

A: Direct factory sourcing often yields better pricing for core SKUs and customization, while distributors offer better stock availability, faster delivery, and easier warranty handling. A blended approach is common.

Q4: What should I look for in supplier certifications?

A: Look for ISO 9001, CE, and relevant safety certifications, plus documented QA/testing, material traceability, and clear warranty terms.

Q5: How long does it take to receive wholesale orders?

A: Lead times vary by category and supplier. Cardio and strength machines typically take 2–6 weeks, while smaller items and mats may ship in 1–3 weeks. High-demand items can take longer.

Q6: What is the typical minimum order quantity (MOQ)?

A: MOQs depend on the SKU and supplier. For large machines, MOQs are often 1–3 units per SKU; for smaller items, MOQs commonly range from 10–50 units.

Q7: How can I negotiate better prices?

A: Use volume commitments, lock-in price protection, request bundled deals, and negotiate favorable payment terms. Build a relationship with a primary supplier for predictable pricing.

Q8: What are the main logistics considerations?

A: Compare FOB vs. DAP terms, evaluate freight options (air vs. sea), assess packaging to prevent damage, and plan for efficient on-site installation and space planning.

Q9: How do I manage warranty and after-sales service?

A: Ensure clear warranty terms in the contract, establish a spare-parts inventory, and set up a service network with response-time commitments and on-site support where needed.

Q10: What role does quality control play in wholesale purchases?

A: Quality control minimizes downtime and returns. Implement PSI inspections, test random samples, and verify supplier QA processes before shipment.

Q11: How can I reduce total landed cost?

A: Consolidate shipments, negotiate better freight terms, source from nearby suppliers to reduce freight, and balance inventory levels with precise demand forecasting.

Q12: Are there regulatory considerations for gym equipment?

A: Yes. Depending on region, you may need compliance with safety standards, electrical certifications for cardio devices, and import documentation for cross-border orders.

Q13: What about sustainability in wholesale sourcing?

A: Look for suppliers with recycled materials, energy-efficient designs, and repairable components. Consider lifecycle cost analysis to extend equipment lifespan and reduce waste.