Who Makes Image Fitness Equipment?

Overview: Who Makes Image Fitness Equipment?

In the fitness industry, the image of a brand often hinges on the quality, reliability, and aesthetics of the equipment it offers. Understanding who makes fitness equipment—whether under an OEM (original equipment manufacturer), ODM (original design manufacturer), or private-label model—helps brands and buyers evaluate risk, timeline, and total cost of ownership. The landscape is global, with design studios in Europe and North America, manufacturing hubs in Asia, and regional assembly sites closer to major markets. This section unpacks the actors in the supply chain, typical business models, and practical implications for purchasers and brand managers.

Key players span three core categories: manufacturers who design and assemble devices (OEM/ODM suppliers), established fitness brands that produce their own lines, and white-label manufacturers who provide modules or fully assembled units to third parties. Each has distinct advantages: OEMs deliver deep engineering capability and component integration; ODMs offer faster time-to-market through shared design frameworks; private-label suppliers enable brands to launch new lines with limited internal R&D. For fitness operators and studios, the choice can affect warranty terms, serviceability, and the ability to customize features such as display interfaces, connectivity, and diagnostic tools.

As of the latest market observations, the global fitness equipment market was valued in the low tens of billions of USD, with growth driven by home-gym adoption, corporate wellness programs, and the rise of connected (IoT-enabled) machines. Cardio equipment remains the largest segment, followed by strength and functional training devices. Importantly, the supply chain is increasingly diverse: while China and Taiwan remain manufacturing powerhouses for many components, Southeast Asia, Europe, and North America host assembly, finishing, and in-market support facilities. This geographic spread helps brands balance cost, lead times, and after-sales service quality.

For buyers, it’s essential to map the full lifecycle of a piece of equipment—from concept and prototyping to mass production, distribution, and retirement. Practical tips include clearly specifying performance standards, validating supplier capabilities through pilot runs, and building redundancy into sourcing strategies to mitigate disruption risks. In the following sections, we examine product categories, partner models, and real-world examples that illuminate how image-conscious fitness brands succeed with the right manufacturing partners.

Product Category Leaders: Cardio, Strength, and Accessories

The equipment used in fitness facilities and homes falls into several interlocking categories, each with its own set of leading manufacturers and typical OEM/ODM dynamics. Manufacturers often specialize or maintain multi-category capabilities to streamline development and ensure a consistent user experience across product lines.

Cardio equipment—treadmills, ellipticals, exercise bikes, and rowers—dominates consumer attention and brand perception. Strength equipment—press machines, selectorized stations, plate-loaded systems, and functional training rigs—drives long-term service considerations and station uptime. Accessories and small equipment (dumbbells, mats, resistance bands, and weight stacks) complete the ecosystem, often sourced from separate specialists. Below are practical insights for each category and how to evaluate manufacturers who supply them.

Cardio equipment manufacturers balance power, durability, and ride feel. When assessing OEM/ODM partners, buyers should scrutinize motor design (DC vs AC motors), drive systems, incline mechanisms, belt or fan noise, frame geometry, and control software. Real-world examples include partnerships with established motor suppliers, control board vendors, and display providers to deliver a cohesive unit with an intuitive user interface. Data-backed validation—such as projected MTBF (mean time between failures), vibration analysis, and thermal management metrics—helps forecast maintenance costs over a 5- to 10-year horizon.

In the strength category, reliability and safety are paramount. Taller and heavier stations require robust frame construction, corrosion resistance, and precise alignment during assembly. OEMs often provide modular components—weight stacks, selectors, pulleys, and cables—that can be configured into multiple machines. Manufacturer support in this space frequently emphasizes safety certifications, test protocols, and standardized service manuals to minimize downtime in high-usage gym environments.

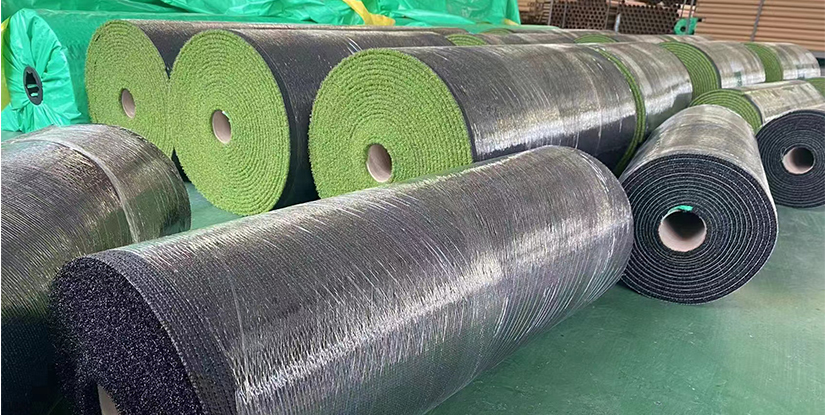

Accessories and small equipment, while lower in unit cost, impact the perceived value of a brand. High-quality rubber compounds, ergonomic grip materials, and durable upholstery can differentiate a premium line from bargain alternatives. Vendors commonplace in this segment provide standardized SKUs with consistent color options and warranty terms, enabling faster product launches and easier inventory planning for operators.

Cardio Equipment Manufacturers: Treadmills, Ellipticals, and Bikes

Cardio machines are often the centerpiece of gym floors and home studios. The best manufacturers optimize for performance, durability, and serviceability, with attention to:

- Motor reliability and noise levels (DC motors are common; some high-end treadmills use brushless designs for longevity).

- Drive systems and belt quality, including anti-slip materials and long-life rollers.

- Control interfaces, including touchscreens, member management, and firmware update capabilities.

- Biomechanics and cushioning to reduce joint impact while delivering a natural stride.

- Safety and accessibility features, such as emergency stop mechanisms and clear instruction labeling.

Best practice steps for selecting cardio partners include running a 1,000-hour real-world test, evaluating service response times, and requesting provide-by-prototype data (PDP) for heat generation, motor current, and power draw across duty cycles. Case studies from boutique studio chains show that a well-chosen cardio partner reduces downtime by 20–35% within the first year and improves member satisfaction scores by 5–10 percentage points due to smoother operation and faster firmware updates.

Strength and Functional Training Machines: From Plate-Loaded to Selectorized

Strength equipment emphasizes load-bearing capacity and ease of maintenance. OEMs commonly offer modular frames, interchangeable stations, and lightweight, durable components to facilitate routine servicing. When evaluating suppliers, consider:

- Frame weld quality, corrosion resistance, and powder coating durability in humid environments.

- Weight stack integrity, including precise pulley ratios and quiet, smooth cable systems.

- Ergonomic design and user safety features, such as pinch-point guards and intuitive adjustments.

- Maintenance programs, spare parts availability, and documented service intervals.

For rigorous facilities—hotels, corporate campuses, or multi-site operators—select a partner that offers a long-term parts strategy, a transparent warranty framework, and on-site installation support. Real-world deployments show that standardized modular components reduce total cost of ownership by enabling easier component swaps and scalable upgrades as gym footprints evolve.

Partnering with Manufacturers: Practical Guides, QA, and Compliance

Choosing the right manufacturing partner is a multi-criteria decision. It blends technical capability with business fit, supply reliability, and post-sale support. A disciplined sourcing framework improves outcomes and reduces risk across cycles of design, prototyping, and mass production.

Practical steps for selecting an OEM/ODM partner include defining clear design requirements, requesting a detailed bill of materials (BOM) and bill of process (BOP), and performing a mini-pilot run. The pilot should cover mechanical fit tests, electronics integration, software stability, and packaging readiness for distribution. In addition, a robust supplier assessment should evaluate:

- Quality management systems (ISO 9001, ISO 13485 where applicable, and supplier-specific certifications).

- Electrical safety and environmental compliance (CE marking, UL listing, RoHS/REACH adherence).

- Manufacturing maturity (lead times, capacity buffers, and contingency planning).

- Warranty terms, return policies, and after-sales service networks.

- Data security and firmware update controls for connected devices.

Quality assurance must be baked into every stage, from incoming materials inspection to final functional testing. A structured QA plan typically includes dimensional checks, load testing, endurance cycling, and traceability for critical components. For brands exporting to multiple markets, ensure that regional certifications are aligned with product variants to prevent costly rework at border crossings or distributor hubs.

Trends, Case Studies, and Real-World Applications

Manufacturers and brands increasingly adopt smart, connected features to differentiate equipment and improve maintenance efficiency. IoT-enabled machines can provide remote diagnostics, predictive maintenance alerts, and usage analytics that empower gym operators to optimize floor space and energy consumption. Case studies from mid-size gym operators and boutique studios demonstrate how strategic partnerships deliver faster time-to-market, improved uptime, and better member engagement.

Case Study A highlights a boutique brand that partnered with a mid-sized OEM to co-develop a signature treadmill line featuring a contemporary console, guided workouts, and remote firmware updates. The result was a 6-month shorter time-to-market window and a 15% reduction in service calls in the first year, compared with a traditional supply arrangement. Case Study B illustrates a regional gym chain scaling a private-label line through an ODM partner, achieving standardized units across 120 locations and a 20% improvement in inventory turns due to common spare parts and simplified maintenance procedures.

Beyond these examples, emerging players focus on modularity, open APIs, and flexible colorways to satisfy diverse operator requirements. The ability to customize equipment aesthetics and software configurations without delaying production is increasingly a competitive differentiator. Always demand a detailed roadmap for software updates, data privacy controls, and interoperability with partner ecosystems (fitness apps, wearables, and facility management platforms).

Sustainability and Life Cycle Considerations

Environmental responsibility matters to operators, brands, and end users. Manufacturers are increasingly incorporating recycled or readily recyclable materials, designing for longer service life, and offering take-back programs at the end of a machine’s life cycle. Considerations include:

- Material selection for frames and components to maximize recyclability without sacrificing performance.

- Repairability and component modularity to extend life through part swaps rather than full replacements.

- Supply chain transparency and responsible sourcing (traceability of steel, aluminum, and rubber compounds).

- Packaging optimization to reduce waste and transport emissions.

Practical applications include setting a policy for spare parts availability across a minimum five-year horizon and integrating take-back programs with recycling partners. Brands that publish sustainability data and third-party certifications often gain trust with consumers, facilities operators, and regulatory bodies.

Future Outlook and How to Evaluate Suppliers

The next decade is likely to bring deeper integration of IoT, cloud analytics, and personalized fitness experiences. Manufacturers that offer robust software platforms, secure data practices, and scalable production models will be better positioned to support premium brands and large networks of facilities. When evaluating suppliers for the future, focus on:

- Technology roadmap alignment with your product strategy (connectivity, firmware updates, data analytics).

- Lifecycle cost modeling, including maintenance, energy use, and spare parts availability.

- Flexibility to accommodate evolving product lines and regional requirements.

- Quality metrics and proven track record across multiple product categories.

Proactive collaboration, clear contractual terms, and transparent product roadmaps enable tighter alignment between brand expectations and manufacturing capabilities. A well-structured partnership can shorten cycles, reduce risk, and deliver consistently high-quality equipment that upholds a brand’s image for reliability and innovation.

FAQs

1. What is the difference between OEM and ODM in fitness equipment manufacturing?

OEM refers to original equipment manufacturing where the supplier builds equipment to the client’s design and specifications. ODM covers both design and manufacturing, meaning the supplier contributes to the product’s design as well as production. Brands choose OEM for tighter control and IP protection, while ODM can speed time-to-market and reduce internal R&D needs.

2. Which regions dominate fitness equipment manufacturing?

Asia remains a major hub for components and assembly, with China, Taiwan, and Southeast Asia playing key roles. Europe and North America host design centers, high-end assembly, and after-sales service networks. Geographic diversification helps balance cost, lead times, and regional compliance requirements.

3. How should a brand evaluate a cardio equipment supplier?

Assess motor quality, drive system reliability, user interface design, firmware update mechanisms, warranty terms, and service availability. Request endurance test data, MTBF metrics, and references from other operators. Conduct a pilot production run to validate performance under real-use conditions.

4. What certifications are important for fitness equipment?

Common standards include CE (Europe), UL (USA), FCC (electronics), RoHS/REACH environmental compliance, and ISO quality management systems. Specific product types may require additional certifications (e.g., electrical safety, fire resistance). Always verify regional certification needs for target markets.

5. How can SMEs compete with larger brands in equipment sourcing?

SMEs can leverage private-label partnerships, modular design, and rapid prototyping. Building strong supplier relationships, focusing on niche segments, and prioritizing after-sales support can create differentiation without large-scale manufacturing capacity.

6. What role does sustainability play in choosing manufacturers?

Sustainability affects brand perception and regulatory compliance. Look for suppliers with recycled materials, take-back programs, energy-efficient production, and transparent environmental reporting. It can also influence cost through long-term savings in waste handling and compliance management.

7. How important are software and IoT capabilities in equipment today?

Very important. Connected machines enable remote diagnostics, predictive maintenance, usage analytics, and enhanced member experiences. Ensure data security, privacy controls, and long-term software support when selecting a partner.

8. Can a boutique brand work with an ODM partner?

Yes. ODMs can accelerate time-to-market with flexible design configurations and scalable production. A careful contract should protect IP and specify design ownership terms while enabling the brand to customize aesthetics and software.

9. What is the typical lifecycle for fitness equipment?

High-use gym equipment often has a 5–10 year lifecycle with annual maintenance. Cardio machines may require more frequent electronics checks, while strength systems emphasize frame integrity and component wear. Planning for spare parts availability is critical for lifecycle cost management.

10. What should a pilot run include before full-scale production?

A pilot should test mechanical fit, electrical integration, software stability, safety features, packaging, and shipping readiness. Collect data on assembly time, defect rates, and field repair requirements to inform the final production plan.